Principal protection with the opportunity for growth

Your plan now offers Nationwide Indexed Principal Protection®

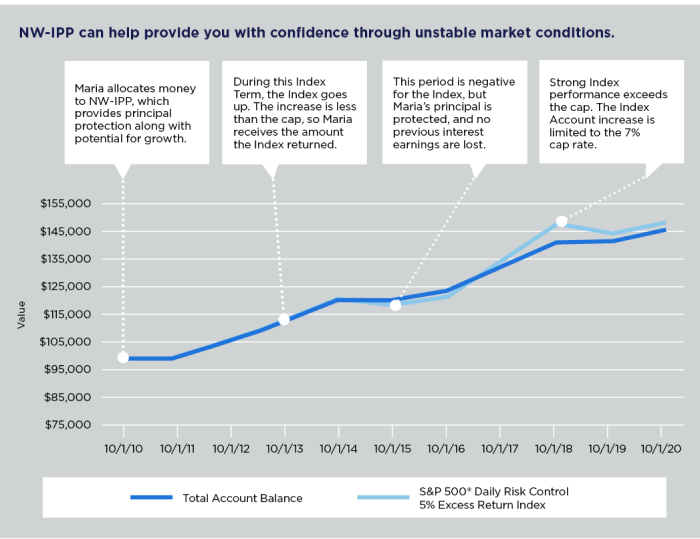

Nationwide Indexed Principal Protection (NW-IPP) is a long-term savings option that protects your principal. That means no matter what the market does, your money is protected and you retain the opportunity for upside potential.

Potential benefits of NW-IPP:

Case study 1: Exchange In

1. At any time, Maria can exchange any dollar amount from another investment option in her retirement plan.

2. Money allocated to NW-IPP goes into an Interest Account that earns daily interest until the end of the current quarter.

3. At the beginning of the next calendar quarter, money sitting in the Interest Account is swept into an Index Account for one year.

4. Interest earnings are credited to the Index Account at the end of the one-year Index Term and depend on the return of the Index, subject to the cap rate.

5. The one-year Index Term automatically renews with a new cap rate. Any interest earnings are locked in and the new principal amount is protected for the following year.

Case study 2: Payroll Deduction

1. Every pay cycle, money is deducted from Craig’s paycheck and contributed to his retirement plan account.

2. The money is then invested according to his allocations. Up to 100% of a portfolio can be allocated to NW-IPP.

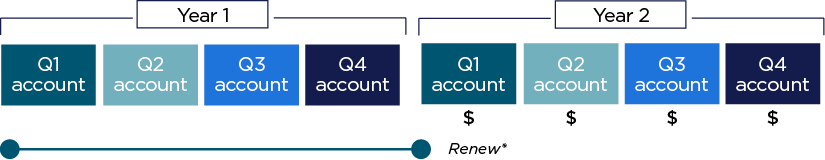

3. Money allocated to NW-IPP goes into an Interest Account that earns daily interest until the end of the current quarter.

4. At the beginning of each quarter, money sitting in the Interest Account is swept into a new Index Account for one year. It’s possible to have up to four Index Accounts at any given time.

5. Interest earnings are credited to each Index Account at the end of the one-year Index Term and depend on the return of the Index, subject to the cap rate.

6. Each one-year Index Term automatically renews with a new cap rate. Any interest earnings are locked in and the new principal amount is protected for the following year.