[1] Prior to allocation to Lifetime Income Builder, the funds in the series will have a 5% allocation to the Nationwide Fixed Investment Contract.

[2] Guarantees are subject to the claims-paying ability of Nationwide Life Insurance Company.

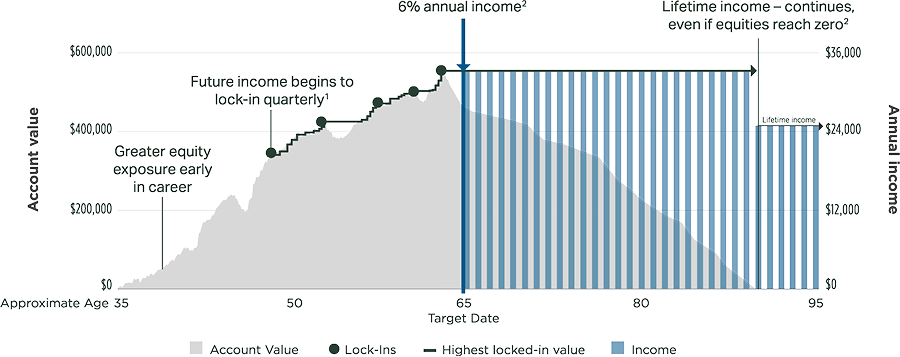

[3] Starting around age 50.

[4] If the equity portion of the target date fund with Lifetime Income Builder ever reaches zero, the annual income benefit will adjust from 6% to 4.5% of the income base.

[5] “Types of Institutional Retirement Income Products Overview,” Institutional Retirement Income Council, updated August 20, 2021.

The Nationwide Collective Investment Trust (“NCIT”) is a bank-sponsored collective investment trust (“CIT”) and not a mutual fund. The NCIT is composed of individual collective funds including the NCIT American Funds Lifetime Income Builder Series (“Series”) of target date funds (“Funds”). Because the CIT is not registered with or required to file prospectuses or registration statements with the SEC or any other regulatory body, neither one is available. Investors should consult the Offering Memorandum for the Series and carefully consider the investment objectives, risk, charges, and expenses of the Funds before investing. It is possible to lose money by investing in the CIT. Global Trust Company (“GTC”), a Maine Chartered Non-depository Trust Bank, is the CIT Trustee and maintains ultimate fiduciary authority over the management of, and investments made in, the CIT. Nationwide Fund Advisors (“NFA”) is an investment advisor to the Series. The CIT is exempt from registration under the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended. Neither NFA, nor the Trustee, has any obligation to update this summary. This summary has not been approved by the Securities and Exchange Commission or any other federal or state regulatory agency or foreign securities commission. For further information, qualified plan participants should consult their plan sponsors.

Participation in collective investment funds is limited to qualified defined contribution plans and certain state or local government plans and is not available to IRAs, health and welfare plans, certain Keogh plans, or the general public. Collective funds may be suitable investments for participants seeking to construct a well-diversified retirement savings program, but diversification does not assure a profit, nor does it protect against loss of principal. This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional. This Series is not available in all states.

Target Date Funds are designed to provide diversification across a variety of asset classes, primarily by investing in underlying funds. In addition to the expenses of the Funds, each investor is indirectly paying a proportionate share of the applicable fees and expenses of the underlying funds. Each Fund is subject to different levels of risk based on the types and sizes of its underlying asset class allocations and its allocation strategy. Although target date portfolios are managed for investors on a projected retirement date time frame, the allocation strategy does not guarantee that investors' retirement goals will be met.

Each fund in the series invests primarily in underlying funds and one of two group annuity contracts issued by Nationwide Life Insurance Company (“Nationwide”), an affiliate of NFA. All contractual guarantees are backed solely by the claims-paying ability of Nationwide. Capital Group manages the underlying American Funds, but the underlying funds and their allocations in the Investment are determined by NFA, subject to the approval of the Trustee.

Key Risks: Each Fund is subject to different levels of risk, based on the types and sizes of its underlying asset class allocations and its allocation strategy. Each Fund’s underlying funds may be subject to specific investment risks, including but not limited to: stock market risk (equity securities); default risk and interest rate risk (bonds); currency fluctuations, political risks, differences in accounting and limited availability of information (international securities); and derivatives risk (many derivatives create investment leverage and are highly volatile). Please refer to the most recent Offering Memorandum for a more detailed explanation of the Fund’s principal risks. There is no assurance that the investment objective of any fund (or that of any underlying fund) will be achieved or that a diversified portfolio will produce better results than a non-diversified portfolio. Diversification does not guarantee returns or insulate an investor from potential losses, including the possible loss of principal.

Nationwide, Capital Group, home of American Funds, and Global Trust Company are separate and non-affiliated companies.

The third-party marks and logos listed are the intellectual property of each respective entity and its affiliates.